India’s stocks decline following surprise election

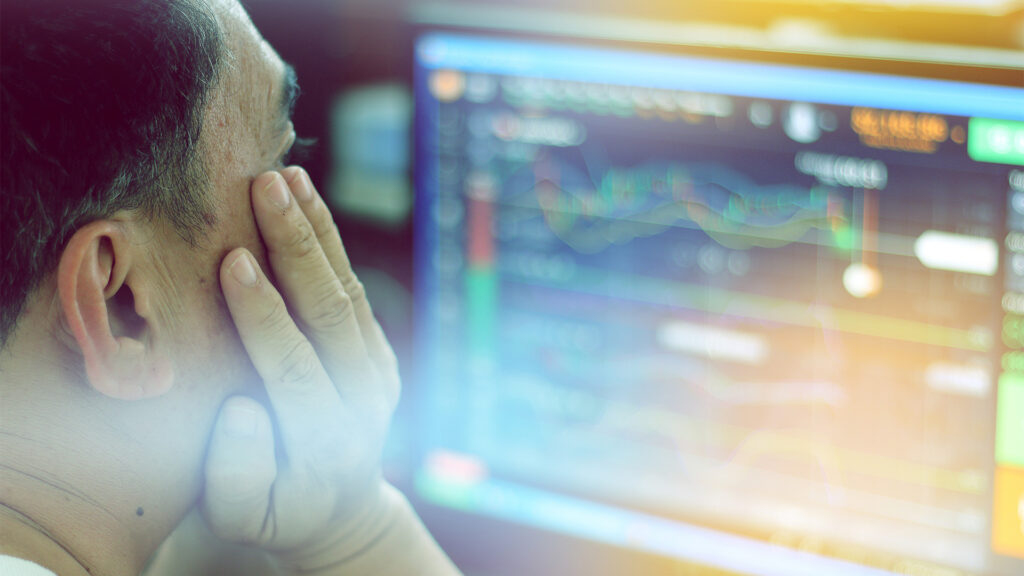

India’s stocks appear to be selling down for a second consecutive day today, following Tuesday’s significant slump in response to the surprising election outcome. The markets tumbled on Tuesday in volatile trading, as it slowly became apparent that the government of Prime Minister Modi had fallen far short of its bombastic hopes for a crushing […]

India’s stocks decline following surprise election Read More »