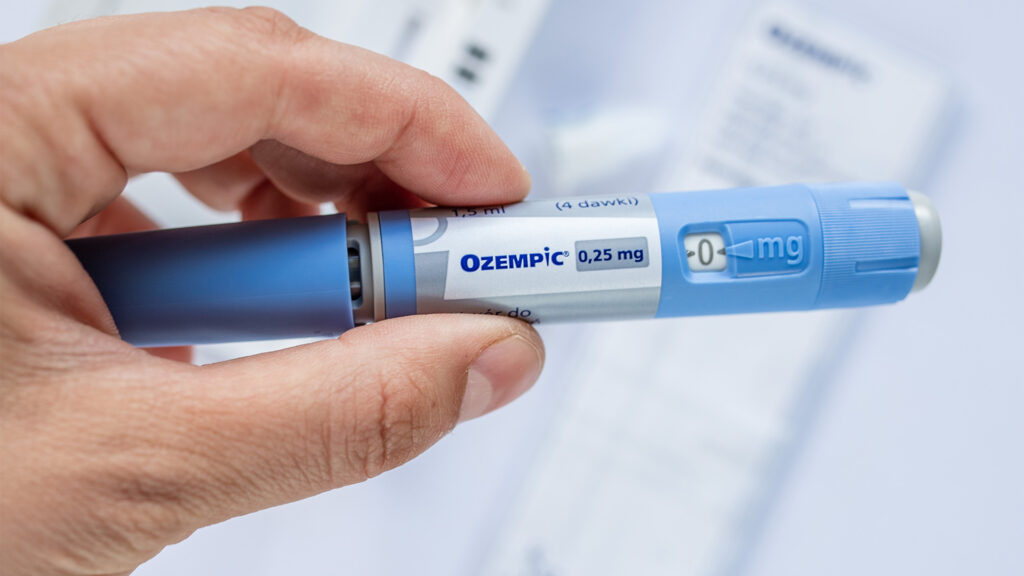

Ozempic, the miracle drug initially designed to combat diabetes but now renowned for its effectiveness as a weight-loss treatment, is sending shockwaves through the ASX as short sellers bet heavily against its potential impact on market valuations. This pharmaceutical sensation, which has caused a global shortage due to soaring demand for off-label use, is captivating the financial world as short positions against consumer staples stocks outpace long positions by a staggering 4:1 ratio on Wall Street, according to Goldman Sachs.

The reach of appetite-suppressing drugs like Ozempic is extending beyond the food and beverage industry, leading to concerns among investors about the potential ripple effects on various sectors. This trend has been gathering momentum since early 2022 when Ozempic’s off-label use for weight loss surged unexpectedly.

CSL’s Plunge and Walmart’s Remark

Last week, CSL, one of ASX’s prominent companies, experienced a 3.5 percent decline, with a staggering 6.3 percent drop on Thursday alone. This decline followed the abrupt termination of a Novo Nordisk study, revealing the immediate effectiveness of Ozempic in treating kidney disease. Investors are now keeping a close eye on CSL, which is set to host an investor day on Monday.

“In many ways, this theme is a short seller’s dream,” remarked DNR Capital analyst Chris Tynan. “You can extrapolate the impact of a successful fat drug into so many consumer angles. This hasn’t really hit the mainstream retail investor in Australia yet, but in the US, it’s making real waves, and institutional shareholders in Australia are taking notice.”

In Australia, the surge in demand for off-label Ozempic use prompted Novo to inform the Therapeutic Goods Administration in September that the drug’s supply would be limited for the rest of this year and 2024.

Walmart, the retail giant, made a noteworthy statement in the US, suggesting that the impact of GLP-1 drugs like Ozempic is not limited to one side of the equation. Walmart noted that categories such as fitness and related medications improved, and customers taking Ozempic and Wegovy were reducing their junk food purchases.

Rising Popularity of Anti-Obesity Medication

Morgan Stanley analysts anticipate a five-fold increase in the number of Americans taking anti-obesity medication over the next decade, reaching approximately 24 million people, or nearly 7 percent of the population. These medications are known to result in up to a 30 percent reduction in daily calorie intake.

David Allen, portfolio manager at Plato Investment Management, expressed confidence in the potential of anti-obesity drugs, suggesting they could surpass statins in sales. The GLP-1 category could potentially become a $US100 billion ($159 billion) per year market, marking one of the best-selling drugs of all time. Researchers are also working on an oral form, which could further boost its popularity.

Changing Consumer Behavior

Studies have shown that people taking appetite-suppressing drugs tend to opt for healthier food choices such as fish, meat, and fruit, resulting in a shift in consumer preferences. Patients have reported significant reductions in visits to fast food and pizza chains, with reduced consumption of confectionery, baked goods, salty snacks, sugary drinks, and alcohol.

Domino’s Group CEO Don Meij stated that while it is too early to determine substantial changes in consumer behavior in Australia, the company has been closely monitoring the trend in other markets, particularly the US. Coles boss Leah Weckert noted an overall trend toward healthier shopping and increased shelf space allocated to healthier options.

Impact on ASX and Broader Sectors

Investors are now contemplating the potential consequences of the Ozempic effect on company sales and profits. The recent comments by Walmart have raised questions about whether this trend will extend beyond ResMed and CSL and affect broader sectors such as food and fashion.

Jarden head of research Ben Gilbert pointed out that while this phenomenon could benefit companies like Super Retail (Rebel’s parent company), it might have a negative impact on others like City Chic. The financial markets are bracing themselves for the continued impact of Ozempic and similar drugs on various sectors, making this an evolving story to watch closely in the coming years.