Nvidia (NASDAQ: NVDA) posted its third-quarter results for FY2025 after market close on Wednesday, surpassing analysts’ expectations across key metrics. However, despite the strong performance, the company’s stock price has fallen since then, reflecting investor unease over its Q4 guidance and rising costs.

Shares are trading 3.22% lower at US$141.95 as of the time of writing.

Key results exceed expectations

The AI chip leader reported earnings per share (EPS) of US$0.81 on revenue of US$35.1bn, exceeding Wall Street projections of US$0.74 EPS and US$33.2bn in revenue. Nvidia’s data centre business, which accounts for the bulk of its earnings, generated US$30.8bn, a 112% increase year-on-year and well above the US$29bn analysts had anticipated. Gaming revenue also rose, reaching US$3.3bn compared to US$2.8bn a year ago.

CEO Jensen Huang touted the results as a reflection of Nvidia’s role at the forefront of the “age of AI”, stating: “Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training, and inference.”

Hopper and Blackwell are GPU architectures designed to power the demanding AI workloads. Hopper, named after computing pioneer Grace Hopper, includes the flagship H100 chip and is optimised for training and deploying large-scale AI models such as those used in natural language processing and generative AI. Blackwell, Nvidia’s next-generation GPU, is expected to build on Hopper’s success with advancements in processing power and efficiency.

Hotly anticipated results meet mixed market reaction

The report was highly anticipated, with Nvidia riding a wave of AI-driven growth that had pushed its stock up over 190% year-to-date. Investors, however, showed lukewarm enthusiasm. After briefly hitting an intraday record, the stock retreated as markets digested the company’s fourth-quarter forecast.

Nvidia expects Q4 revenue to reach US$37.5bn, plus or minus 2%, slightly ahead of consensus estimates of US$37bn but below more bullish projections of US$41bn. The cautious outlook, combined with a lower gross margin forecast of 73.5%, down from 75% in Q3, dampened sentiment.

Reasons for the share price drop

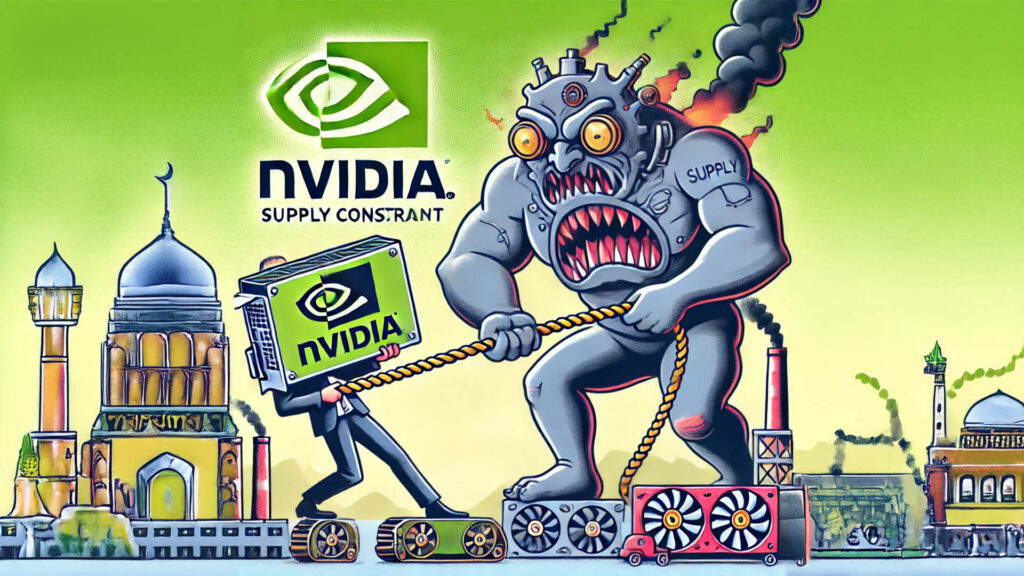

The stock’s decline reflects sky-high expectations for Nvidia, where even strong results fall short of sustaining its meteoric rise. Concerns about rising production costs for its next-generation Blackwell chips also weighed on sentiment. CFO Colette Kress acknowledged ongoing supply constraints and projected that demand for Blackwell GPUs would exceed supply for several quarters.

Additionally, geopolitical risks loom. President-elect Donald Trump’s proposed tariffs on Taiwan-made chips — critical to Nvidia’s supply chain — could erode margins or lead to higher costs for customers. Taiwan Semiconductor Manufacturing Company (TSMC) is the primary manufacturer of Nvidia’s GPUs.