By Dr Shane Oliver, Chief Economics and Head of Investment Strategy at AMP.

Investment markets and key developments

Share markets were mixed over the last week with uncertainty remaining high around the impact of Trump’s tariffs but no big new negative announcements. For the holiday shortened week though US shares fell 1.5% with Fed Chair Powell indicating that the Fed won’t be rushing in with rate cuts to support markets and Trump reigniting concerns about Fed independence. Against this Eurozone shares rose 3.7% (playing catch up to the rebound in the US shares the week before) and Japanese and Chinese shares were also on track to rise. For the week, the Australian share market rose 2.3% led by resources, financial, property and health shares. Bond yields mostly fell, with the US reversing some of its sharp rise the previous week on the back of a loss of confidence in the US’ safe haven status. Oil and copper prices rose but iron ore prices were flat. Gold rose to a new record high and the $A rose again with both helped by further falls in the US dollar.

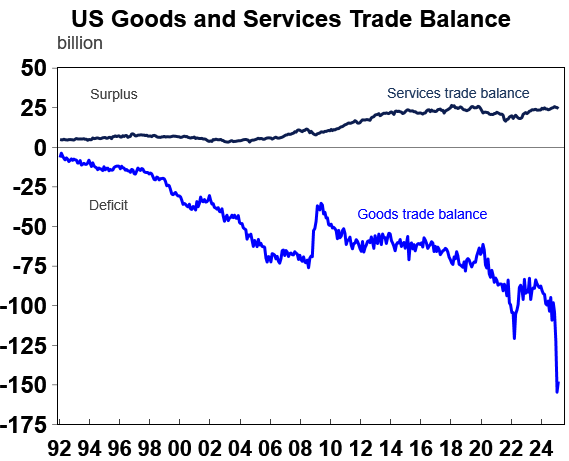

The past week has thankfully been a bit of a quieter on the tariff front enabling a somewhat calmer ride for investment markets. However, the tariff mayhem hasn’t gone away. Trump’s backdown on the reciprocal tariffs and on smart phones and computers – under pressure from markets and industry – provide grounds for optimism that he still faces constraints and will backdown more broadly at some point (after declaring victory of course!). And the Trump Administration now appears to be trying to calm bond and share markets down by trying to negotiate some quick trade deals with some countries, eg, Japan. But against this Trump has flagged more tariffs ahead for semiconductors which could encompass computers and smart phones and for pharmaceuticals, the growth of sectoral tariffs will make it hard some countries to agree deals on the reciprocal tariffs if much of their exports are still hit by high sectoral tariffs (like Japan where its over 55%) and his comedic justification for the reciprocal tariffs and constant flip flops has likely weakened his bargaining power. While some countries no doubt will cut deals that will be paraded as “never before seen victories”, some including the EU may be less inclined unless Trump backs down a lot. This is particularly the case with China. While White House Press Secretary Leavitt – and Trump – seem to think that “China needs to make a deal with us. We don’t have to make a deal with them…China wants the American consumer…they need our money”, China may see it the other way round leading to a lengthy standoff. And in the meantime, hard economic data is likely to worsen as supply chains are disturbed and spending, hiring and investment decisions are delayed due to the hit to confidence leading to a weaker profit outlook. In the meantime, the US’ services trade surplus and in particular its tourism industry looks likely to take a hit as global travellers divert their travel away from the US in protest.

Source: Macrobond, AMP

So, with more to go on the tariff front and related fall out it remains too early to say that we have seen the low in US, global and Australian shares. This is particularly the case with renewed fears that Trump might start to threaten Fed independence. Any threat to Fed independence would further threaten faith in the US as a safe haven and lead to renewed market stress. This has arisen again with a court case heading to the US Supreme Court in relation to two heads of independent regulatory agencies that were fired by Trump and Trump posting that “Powell’s termination cannot come fast enough” after Fed Chair Powell indicated that the Fed was in no rush to start cutting rates again. The Fed’s independence is critical to keeping inflation expectations and inflation low in the US and more broadly to maintaining confidence in US bonds and the $US at a time when a loss of investor confidence in the US Government’s economic policies are calling that into question. Any move by Trump to remove or weaken the Fed’s independence would lead to a re-intensification of market stress with even more upwards pressure on US bond yields and downwards pressure on the $US as investors would demand a higher risk premium to invest in the US. This in turn will increase the risk of US financial turmoil and US recession. Treasury Secretary Bessent has said Fed independence “has got to be preserved” but Trump threatening it is a real risk given the absence of enough “adults in the room” able to explain the importance of maintaining it to him.

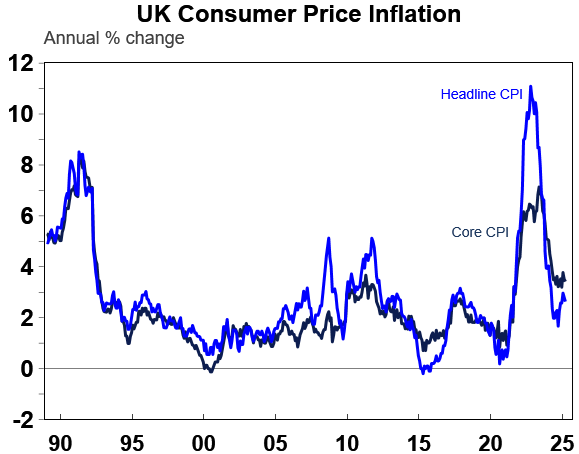

It’s a pity that were it not for Trump’s move to try and blow up the global trading system, markets this year could have celebrating the success of central banks in getting inflation back under control with limited damage to economic growth. This was further evident in the last week with lower-than-expected readings for underlying inflation in Canada, the UK and New Zealand and the ECB cutting rates again and all are likely to cut rates further this year.

The same is likely to apply in Australia with the RBA minutes noting a preparedness to cut rates again with the May meeting seen as providing an opportunity to revisit monetary policy after another round of data on inflation, wages, the labour market and economic trends with updated forecasts and more information on Trump’s trade war. Jobs data just released for March didn’t alter the impression of a still solid labour market and on their own don’t provide any urgency for the RBA to act but we continue to expect lower March quarter underlying inflation data and the trade shock to drive a 0.25% cut in May with around a 35% chance of a 0.5% cut with several more rate cuts into early next year.

Apart from April business conditions PMIs’ the week ahead will be relatively quiet for data releases in Australia as it’s also a shortened week due to Easter and ANZAC Day. The main focus will be the week after where we expect the March quarter CPI (30 May) to show a 0.8%qoq rise with some energy rebates rolling out but annual inflation falling to 2.3%yoy from 2.4%yoy and trimmed mean inflation of 0.6%qoq or 2.8%yoy which is less than RBA expectations for a 0.7%%qoq rise. This will see trimmed mean inflation back in the target range for the first time since the September quarter 2021 and the six-month annualised pace of inflation fall to just 2.2% which is below the mid-point of the target range, and we expect this will help set the scene for the RBA to cut rates in May. The local money market has priced in nearly five 0.25% rate cuts by year end.

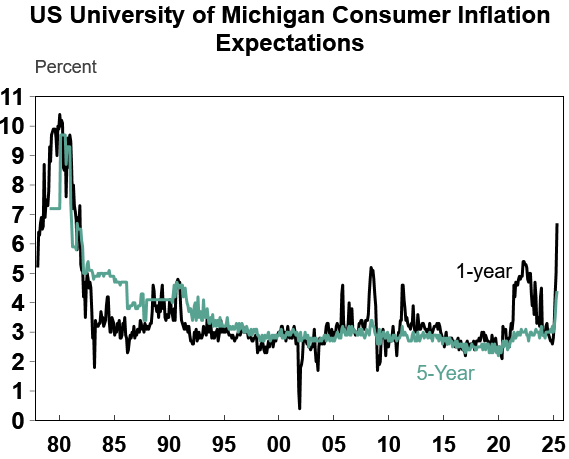

For the US Federal Reserve it’s all a lot more complicated given that it’s the country imposing the tariffs on its imports so they threaten both weaker economic activity and jobs and higher inflation in the US if the supposed one-off boost to prices feeds through to inflation expectations as appears to be occurring in the University of Michigan’s consumer survey of inflation expectations. Its not as evident in other surveys, but as Fed Chair Powell has indicated the Fed is wary and so remains in wait and see mode and won’t be rushing in with a “Fed put” (ie lower interest rates) which clearly upset the US share market (and Trump). That said, ultimately, we see the threat to growth dominating, driving the Fed to cut rates around four times this year starting from around June or July.

Source: Macrobond, AMP

The Australian election campaign is not going well for anyone hoping for rational economic policies designed to strengthen the economy. To be fair there is a little bit of that (eg in the Coalition’s focus on removing red tape and Labor’s hint of giving back some bracket creep). But it’s being overwhelmed by both sides trying to outdo each other with a spendathon of measures that will only worsen Australia’s structural budget deficit and debt situation and do little to fix structural economic issues.

· Unfortunately, the array of cost-of-living promises will do nothing to boost productivity and turn around the slump in living standards. They are mostly just band aid solutions.

· The multi-billion dollar off-budget funds are popping up like mushrooms in the shade but are making a mockery of budget discipline. Why do we need a fund to pay down debt? – just pay down debt. And why do we need a fund to build houses? – just build them.

· Both sides of politics continue to focus way too much on demand side policies to deal with housing affordability – with Labor widening the 5% deposit scheme to all first home buyers on top of its Help to Buy Scheme and the LNP promising expensive tax breaks and access to super for first home buyers – which may be good for the lucky few who get in early but will ultimately just boost home prices benefitting existing home owners and making housing affordability even worse. Both sides of politics should agree in the national interest to ditch such schemes and just put all their effort into boosting housing supply – by pressuring states to release more land, speed approvals, cut building times etc. This is the key to making housing more affordable.

· The billions of dollars in spending promises from both sides of politics will add to Australia’s projected decade or more of budget deficits and rising public debt. So far the ALP looks worse at this than the Coalition but the latter’s effective reintroduction of the Low and Middle Income Tax offset may be hard to end after just one year as was the case last time around, its tax break for first home buyers is likely to be far more costly than its estimating and it is committing to more defence spending which hasn’t been detailed yet. So, they may both be similar in terms of adding to the deficit and debt.

· The tax breaks on offer from both sides suggest a further step back from fundamental tax reform and the Coalition’s tax break for first home buyers will introduce yet another complication into our income tax system.

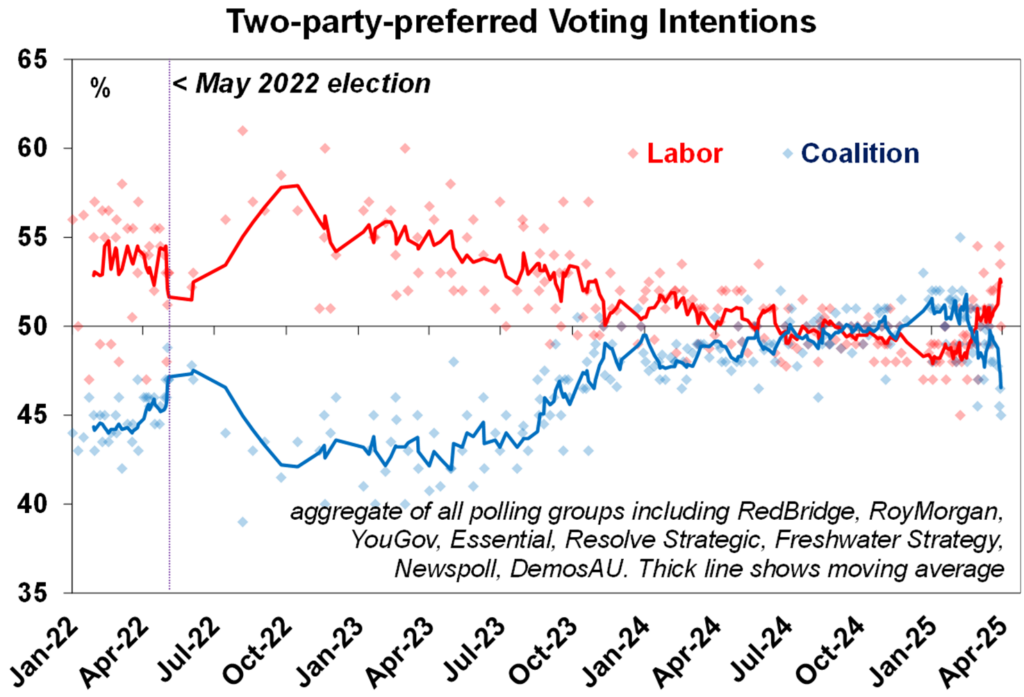

All these handouts – particularly the moves for first home buyers – may be popular but like Easter Eggs they are not good for us! Meanwhile, two party preferred polling has seen Labor’s lead widen, but the risk of losing its three-seat majority resulting in minority government remains high. And of course, there is still another two weeks to go. Interestingly while Trump appeared to benefit the Coalition into January this has now more than fully reversed.

Source: Polls as indicated, AMP

Major global economic events and implications

US economic data was a mixed bag. Initial jobless claims fell and remain low although continuing claims rose. Retail sales rose solidly in March, but this looks due to a recovery from bad weather, the LA fires and front loading ahead of the tariffs. There may also have been a bit of this in the case of manufacturing production. However, regional manufacturing conditions surveys for April were weak with price pressures continuing to rise in response to the tariffs. Meanwhile housing starts fell sharply in March and soft home builder conditions suggest they will remain weak. All up, for now growth in US domestic demand looks okay but it appears to be getting a bit of a boost ahead of the tariffs which risks turning into a slump as the tariffs start to impact.

The European Central Bank cut is deposit rate by 0.25% to 2.25% as widely expected citing the threat from rising trade tensions. Its bias is dovish with less concern about inflation & more concern about growth. Expect further cuts to around 1.5% by year end.

UK inflation came in weaker than expected in March at 2.8%yoy with core inflation falling to 3.4% which along with its lack of retaliatory tariffs, the weaker growth outlook and signs of a softer jobs market add to confidence that the Bank of England will cut rates another 3 or 4 times this year starting again around mid-year.

Source: Macrobond, AMP

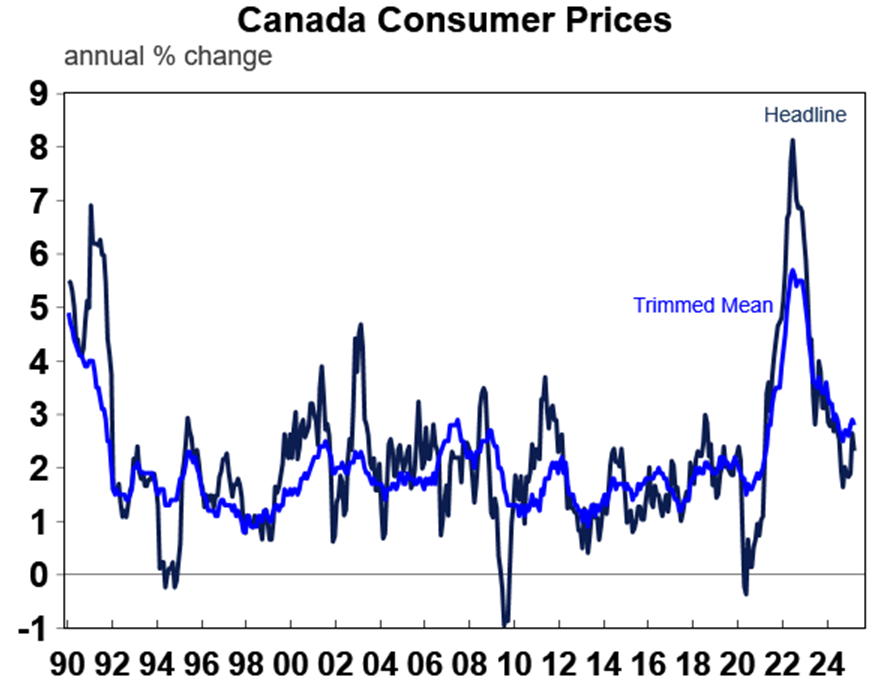

The Bank of Canada left rates on hold at 2.75% after seven straight cuts citing uncertainty around the outlook given Trump’s tariff war. It will likely cut further though as the trade war hits growth with the money market allowing for two more cuts this year. Consistent with this Canadian inflation in March fell to 2.3%yoy and core trimmed mean inflation fell to 2.8%yoy.

Source: Macrobond, AMP

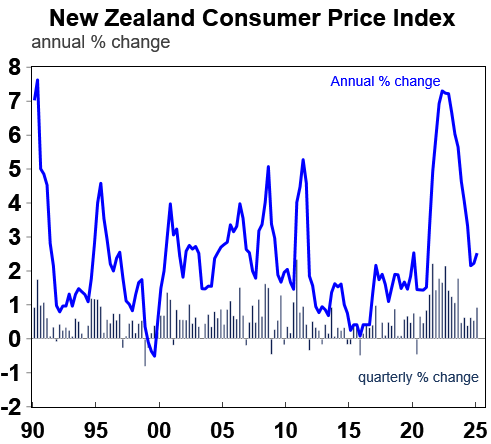

New Zealand’s inflation rate in the March quarter rose more than expected to 2.5%yoy due to higher food, petrol, education and tobacco prices. But underlying measures continued to slow towards the 2% inflation target, with core inflation falling to 2.6%yoy from 3% and trimmed mean inflation falling to 2.3%yoy from 2.5%. The RBNZ is likely to cut another three times this year taking its cash rate down to 2.75%.

Source: Macrobond, AMP

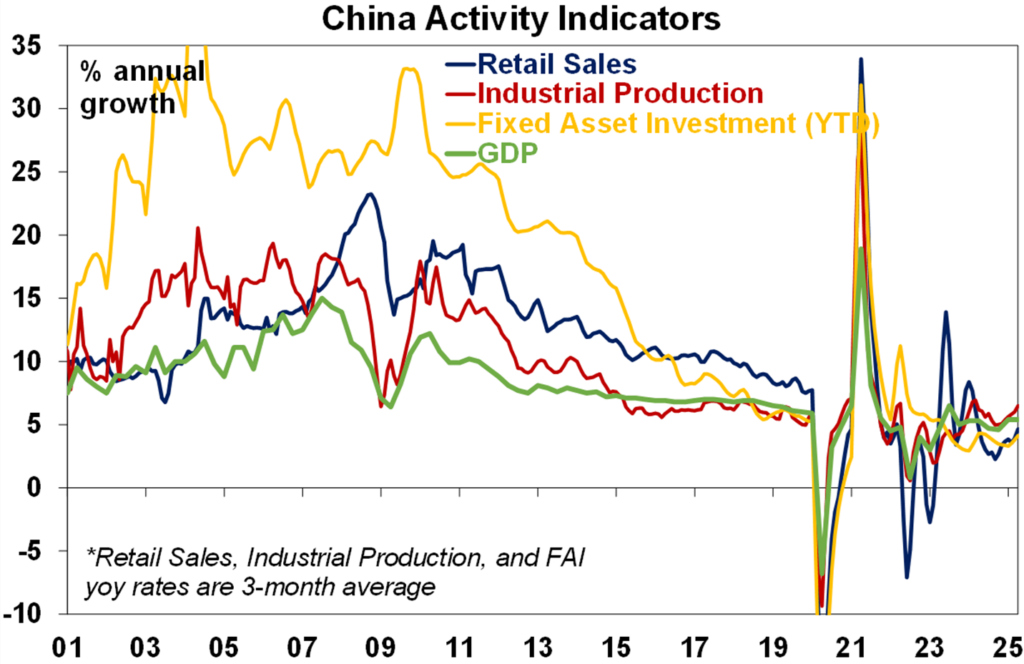

Chinese economic activity came in stronger than expected in the March quarter but expect slower growth ahead. GDP growth held at 5.4%yoy, growth in retail sales and industrial production picked, credit growth rose and unemployment fell. Growth is likely to slow in the June and September quarters though as the US trade war impacts and exports slump and industrial production slows after front running the tariffs in March.

Source: Bloomberg, AMP

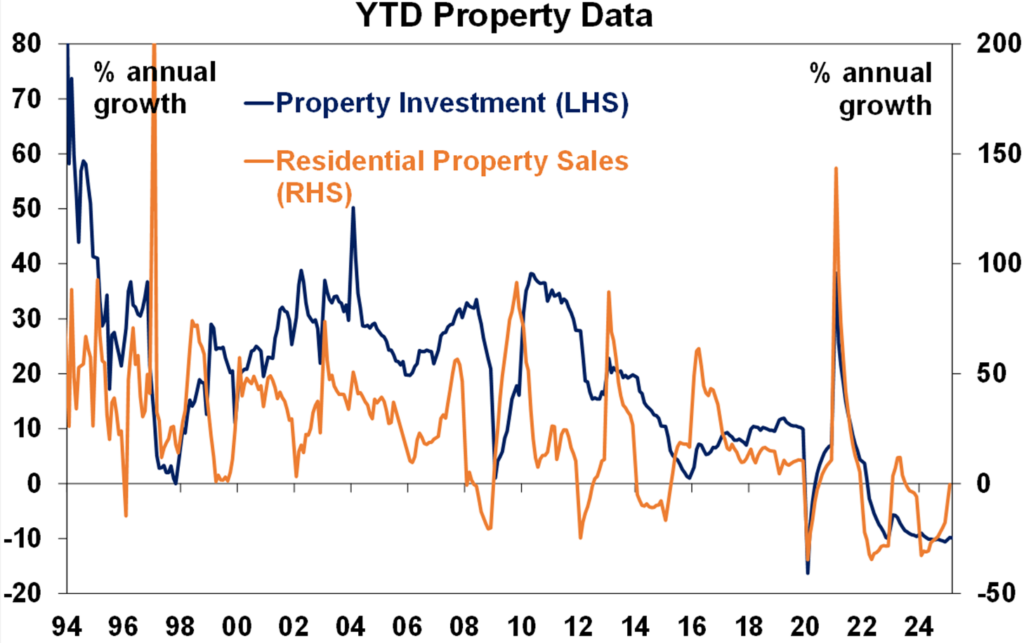

However, the property slump is showing signs of stabilising – with sales stabilising on a year ago and house price falls slowing to a crawl – and the Government is likely to provide sufficient stimulus to at least keep growth above 4%.

Source: Bloomberg, AMP

Australia economic events and implications

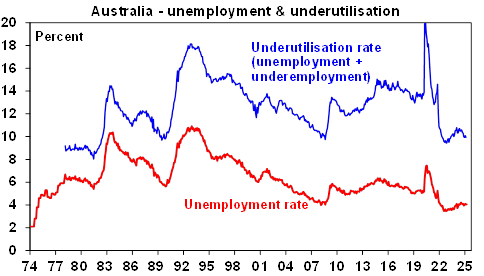

The Australian jobs market remains strong. Employment bounced back by a less than expected 32,200 in March reversing only part of the surprise 57,500 fall in February that partly reflected more than the normal number of older people leaving the workforce. But despite all the noise unemployment and labour underutilisation both remain low in a historical context at 4.1% and 9.9%.

Source: ABS, AMP

However, a combination of the surge in immigration and labour market participation which boosted labour supply, a surge in public sector jobs in the care economy, labour hoarding, and the private sector facing tough economic conditions, likely means that the labour market is not as strong as it appears. This is consistent with the slowing trend in wages growth over the last year. This suggests that while the strong jobs market means there is no urgency to cut rates by the same token it shouldn’t be a barrier to cutting them which as noted earlier, we think will be justified by further evidence of underlying inflation falling back to the mid-point of the target range and the threat to growth from Trump’s trade shock.

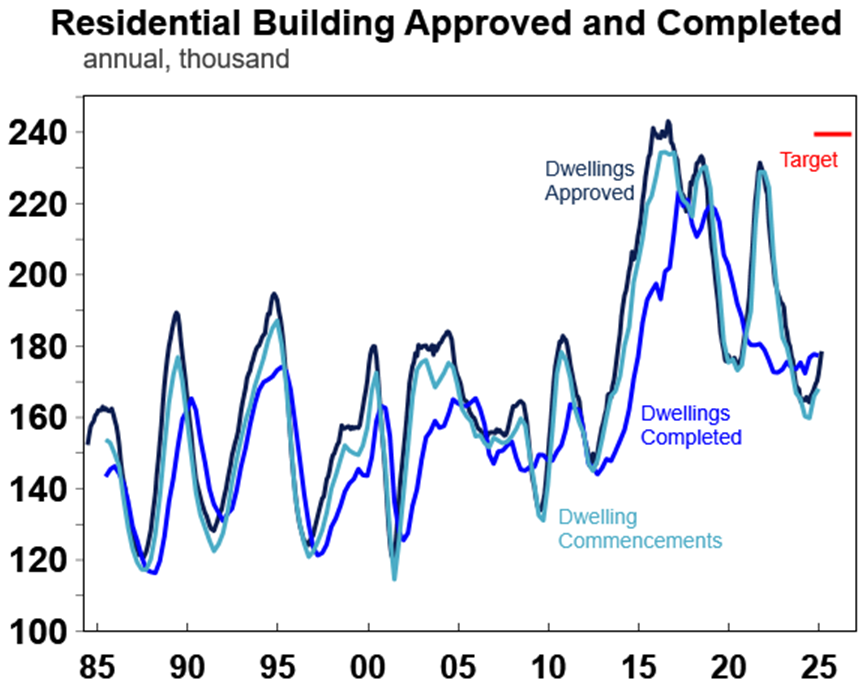

Dwelling completions running well below target. In the December quarter they were running at a stable 180,000 which is well below the Housing Accord target for 240,000 homes a year. Fortunately housing approvals and commencements are now trending up again but they have a long way to go.

Source: Macrobond, AMP

What to watch over the next week?

Tariffs will likely remain the big focus over the next week. We will also see business conditions PMIs released for April (Wednesday) with the 2nd April ratcheting up in Trump’s trade war likely to show up in a deterioration particularly in the US.

US data is also likely to show a solid further rise in durable goods orders but only a modest gain in underlying capital goods orders with a fall in existing home sales (both due Thursday). The flow of March quarter earnings reports will also start to pick up with the consensus seeing a 4.1%yoy rise in earnings, down from 13%yoy in the December quarter. Tech earnings are expected to be up 16.3%yoy and earnings for cyclicals (resources, industrials and consumer discretionary) are expected to be down 7.7%yoy. The earnings reports will also be watched for guidance as to how the tariffs are impacting the outlook.

Outlook for investment markets

Shares are at high risk of further falls given the ongoing tariff war, increased recession risk particularly in the US and the risk of a US/Israeli strike on Iran’s nuclear capability if diplomacy doesn’t work. Even if the low has been seen volatility is likely to remain high. But with Trump likely to ultimately back down further on the tariffs (after declaring victory of course!) and pivot towards more market friendly policies like tax cuts and deregulation, and central banks, including the RBA, likely to cut rates further shares are likely to recover on a more sustainable basis into year end. But it’s likely to be a rough ride.

Bonds are likely to provide returns around running yield or a bit more, as growth weakens, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest with tariff worries constraining buyers and posing a near term threat of a reversal in prices and affordability remaining poor. We see home prices rising around 3% this year.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between the negative impact of US tariffs and the global trade war and the potential positive of a further fall in the overvalued US dollar as its safe haven status comes under question. This could leave it weak around or just below $US0.60 in the near term. Undervaluation should support it on a medium-term view with fair value around $US0.73.

Eurozone shares fell 0.5% on Thursday and the US S&P 500 rose just 0.1% with concerns around Fed independence weighing after an initial gain of around 1%. The roughly flat lead from the US points to a flat start to trade for the Australian share market when it reopens next week but note that the US share market will have another trading session ahead of the ASX reopening on Tuesday.

Ends