The closure of the US port of Baltimore after the harbour was blocked by a bridge collapse on Tuesday will cause significant disruption to American trade along the east coast and into Europe and South America.

The extent of the disruption – especially to car imports their prices nd the impact on inflation – will be a concern for US economic regulators like the Federal Reserve and the US Treasury.

The Francis Scott Key Bridge was brought down after a container ship lost power, gave a Mayday signal and then crashed into a pier. Six people are reported to be missing.

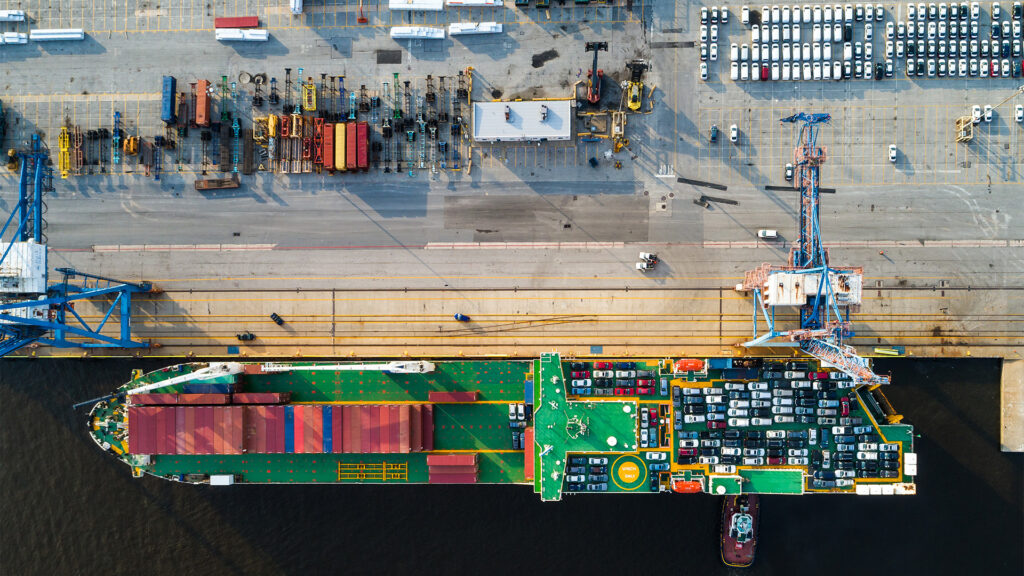

The port handles around $US80 billion of exports and imports a year – mostly coal, cars and general merchandise.

More than 52 million tonnes of cargo moved through the port a year – that’s a million tonnes a week with coal the largest by volume with more than 20 million tonnes being shipped through two coal terminals in the port in the first 9 months of 2023.

It is the second biggest coal port in the US, second after nearby Norfolk, Virginia, according to the US Energy Information Administration (EIA).

It also the main import destination for cars with 847,000, vehicles moved through the port last year, more than any other American with most vehicles imported from Europe.

That’s more than 16,000 vehicles a week and the loss of the port, while shippers will work around it, will worry the US Federal Reserve because of the key role new and used car prices played in firstly boosting US inflation during the pandemic, and then keeping it high in 2023.

Domestically a total of 11 million vehicles use the bridge a year – that’s more than 30,000 a day and its destruction will change the way people commute around Baltimore, as well as drive to and from New York, the New England states, Washington and south along the southeast coast states.

The port is used by two coal handling companies – the coal mining giant, Consolidated and the railroad company, CSX.

CSX on Tuesday told existing coal customers that they should expect “potential shipment delays” after the accident.

CSX owns the Curtis Bay coal pier in Baltimore, located near the site of the collapsed bridge. CSX plans to keep the terminal operational for now as it continues to “assess the circumstances,” the company told Reuters.

Coal producer CONSOL Energy, which has a marine export terminal in the Port of Baltimore, also said that vessel access in and out of its terminal was also delayed.

Most of the coal is exported to Europe.

Many of the vehicles using the bridge are transport trucks and the AP News reported that 1.3 million trucks cross the bridge every year — 3,600 a day.

Trucks that carry hazardous materials will now have to make 30 miles of detours around Baltimore because they are prohibited from using the city’s tunnels, she said, adding to delays and increasing fuel cost, according to American Trucking Associations spokesperson Jessica Gail.

“Aside from the obvious tragedy, this incident will have significant and long-lasting impacts on the region,”, calling Key Bridge and Baltimore’s port “critical components’’ of the nation’s infrastructure,” she said.