By Dr Shane Oliver, Chief Economist and Head of Investment Strategy at AMP.

The key points are:

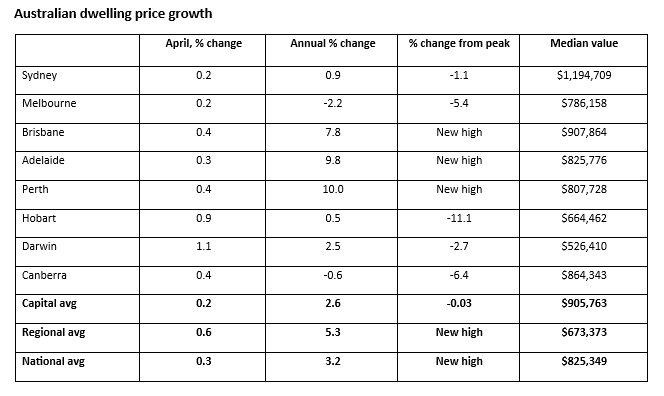

- Cotality (formerly known as CoreLogic) data shows national average home prices rose 0.3% in April, their third monthly rise in a row.

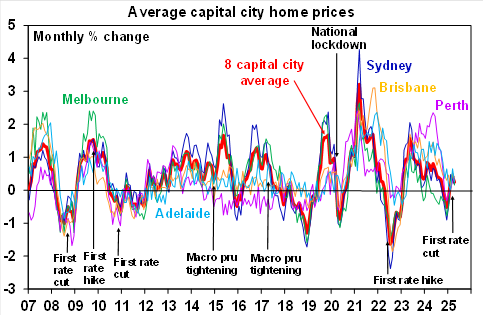

- The upswing has been supported by the RBA’s rate cut in February and expectations of more rate cuts to come, but still high rates and uncertainty caused by Trump’s trade war are likely constraining buyer demand.

- Annual growth in rents slowed to further 3.6%yoy. Slowing student arrivals along with poor rental affordability leading to rising average household sizes have led to some slowing in demand for rental property.

- More RBA rate cuts along with the ongoing housing shortage and more support for first home buyers flowing from election campaign promises are expected to drive a further upswing in average prices this year. However, gains are likely to remain modest as we are starting from a point of very poor affordability, interest rates are only likely to fall modestly, population growth is slowing and divergence across cities will continue.

After 4.9% growth last year, we continue to expect average property prices to rise around 3% this year.

All capital cities saw a rise in April

CoreLogic data shows that national average property prices rose again in April, with buyer sentiment supported by the RBA’s rate cut in late February.

Source: CoreLogic

All cities saw price gains, with Hobart and Darwin up strongly and the booming cities of the last two years, ie Brisbane, Adelaide and Perth, still seeing reasonable gains.

Source: CoreLogic, AMP

Expect further gains in average property prices

Further gains are likely as interest rates fall further, the shortage of property remains and election policies boost first home buyer demand regardless of who wins the election, provided unemployment remains relatively low.

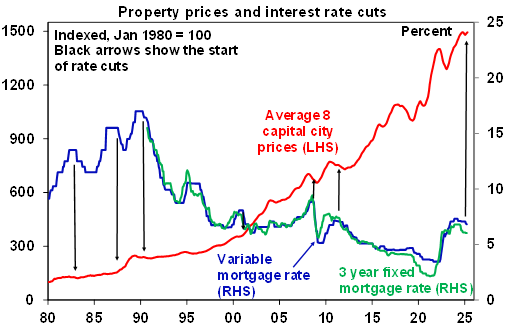

- We expect the RBA to cut again by another 0.25% at its meeting later this month with at least another two more cuts by early next year. Rate cuts are normally positive for home prices as it boosts how much buyers can borrow and hence pay for a property, although sometimes this can show up after a lag following several cuts depending on economic conditions. Roughly speaking each 0.25% rate cut when passed on to variable mortgage rates will add about $9000 to how much a buyer on average earnings can borrow.

Source: RBA, Cotality, AMP

- There is still an ongoing housing shortage which provides a source of support for prices. We estimate the accumulated housing shortfall to be around 200,000 dwellings at least, and possibly as high as 300,000 dwellings and, with home building running well below the Housing Accord objective for 240,000 homes a year, the shortfall is likely to remain for some time to come.

However, the upswing it likely to be modest

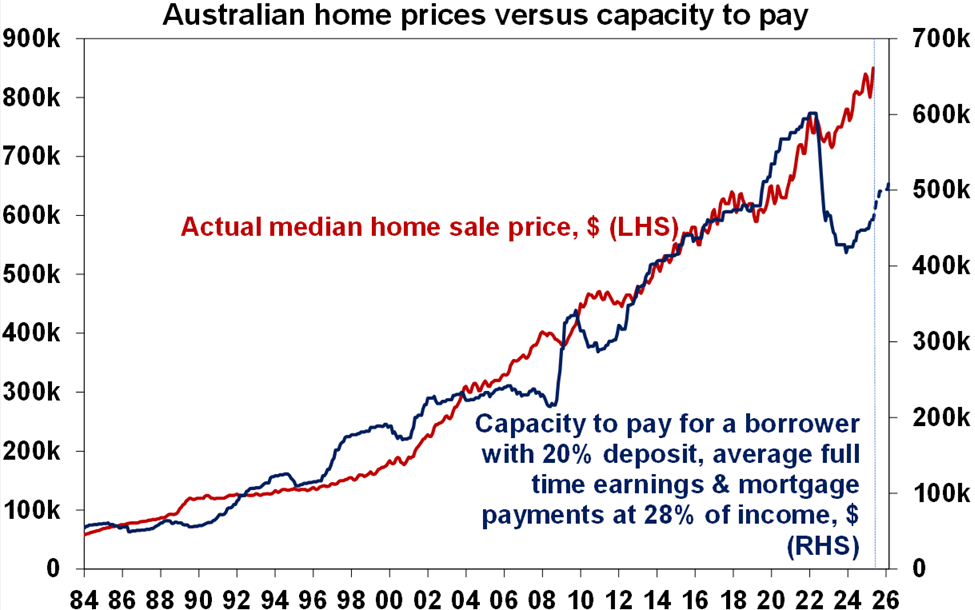

Just as the downswing in average prices into early this year was mild the upswing is likely to be too. This is because it’s starting from a point of still poor affordability, interest rates are only likely to fall modestly, and population growth is slowing.

- In the near-term uncertainty and slightly lower economic growth flowing from Trump’s trade war may be a bit of a dampener on buyer demand and risks a return to falling home prices if the trade war escalates, although we expect this to be offset by the impact of rate cuts through the second half of the year.

- More fundamentally, housing affordability remains very poor without the usual improvement via lower prices that might have been expected to flow from the rate hikes seen in 2022 and 2023. This is evident in the ratio of home prices to wages & incomes being around record levels.

- While interest rates are likely to fall further, in the absence of recession and much higher unemployment we only expect about 4 or maybe 5 rate cuts in total, taking the cash rate back to a low of around 3.1 to 3.35% next year and mortgage rates to around 5 to 5.25%. This will leave mortgage rates well above their record lows seen in 2021 of around 2 to 3%. As such, the buying capacity of home buyers is expected to improve but remain well below the levels seen in 2021-22. See the next chart above. This will limit the upside in property prices.

Source: RBA, Cotality, AMP

- Slower population growth, reflecting a crackdown on student visas and a return to the normal pattern of students leaving after they complete their degrees (after disruption from the pandemic), will likely lead to a further easing in the rental market which will help take some pressure off the home buyer market. Population growth has already slowed from a peak of 663,000 over the year to September 2023 to 484,000 over the year to September last year with the Government projecting a fall to 260,000 in 2025-26 and the Coalition promising to cut this by another 100,000.

- Divergence is likely to limit the upswing in national prices. While the weak cities of the last year – Melbourne, Hobart, Canberra and Sydney – are likely to benefit from lower rates the most – their gains may be partly offset by cooling conditions in the boomtime cities of the last two years – Perth, Adelaide and Brisbane – as they have higher price to income ratios than Melbourne.

So just as the downswing in property prices was modest, the upswing is likely to be modest too. After 4.8% growth last year, we expect average property prices to rise around 3% this year.

What about the election promises for housing?

Using Cotality data since 1980, residential property prices have risen 7.7% pa under Coalition governments and 4.5% pa under Labor.

Going into the Federal election both sides of politics are offering a mix of demand side and supply side policies. On the demand side Labor has a Help to Buy Scheme with 10,000 places a year which will see the Government take a 40% equity stake and it is expanding the low deposit guarantee allowing most FHBs to get in with a 5% deposit. The Coalition will allow first home buyers to access $50,000 of their super and tax deductibility of mortgage interest payments resulting in a benefit of up to $11,000 a year for the first five years. It’s unclear which set of policies will be most attractive to FHBs, but demand side policies have been deployed over and over and while they may be good for the lucky few who get in early, ultimately by boosting FHB’s buying power they just lead to higher home prices – which is great for existing homeowners but not much else.

On the supply side, Labor is focussed on trying to build 1.2 million new homes under the Housing Accord through incentives with the states and a Housing Australia Fund to supply 30,000 social and affordable homes and a new $10bn fund to build 100,000 homes for FHBs. The Coalition promises to invest $5bn in housing infrastructure, halve approval times and cut permanent migration by 25% or 45,000 places, with a total cut to immigration of 100,000 over the next financial year.

On balance the demand side policies will likely dominate the supply side policies ultimately supporting home prices.

What to watch?

The key things to watch will be interest rates, the impact of Trump’s trade policies, unemployment and population growth. For example, a return to RBA rate hikes or less cuts than we are forecasting, a sharply rising trend in unemployment and a sharp slowing in net migration could result in a resumption of property price falls reflecting the divergence between home buyers’ capacity to pay and current home price levels. On the flipside a faster fall in rates on the back of weaker than expected inflation could drive a stronger upswing in property prices.

Ends