Melbourne-based packaging company, Orora (ASX:ORA), is set to raise over $1.3 billion from its shareholders in order to acquire Saverglass, a prominent French glass bottles manufacturer valued at $2.16 billion (1.290 billion euros). This move confirms earlier reports of Orora’s interest in expanding its presence in the European market.

Orora, a spin-off of Amcor, will purchase Saverglass from the US private equity giant, The Carlyle Group. The acquisition aligns with Orora’s strategic efforts to focus more on glass products, particularly in the premium spirits and wine segments. Saverglass was originally acquired by Carlyle in 2016 for an enterprise value of 560 million euros.

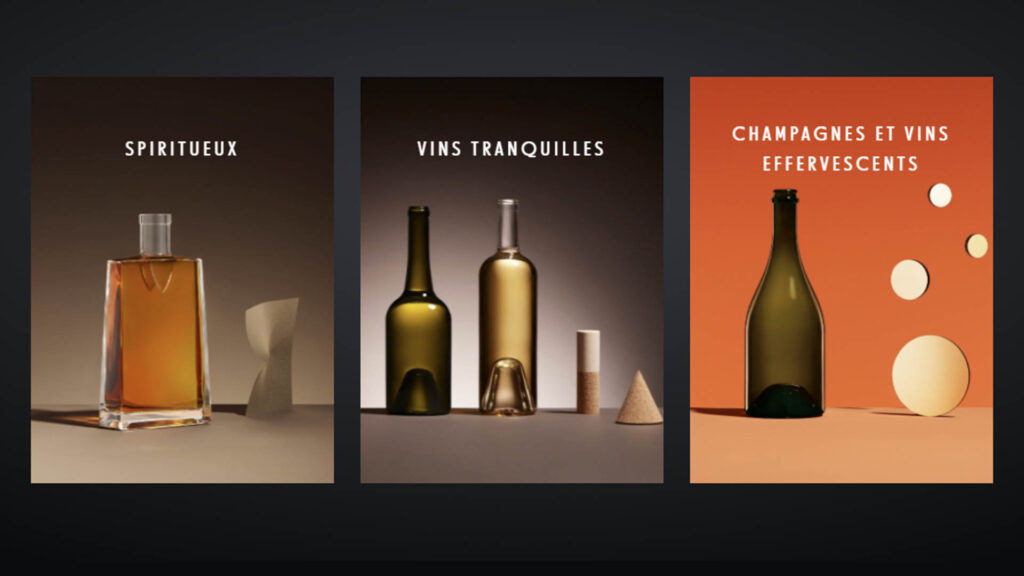

The acquisition positions Orora as one of the world’s largest glass bottle manufacturers, enabling it to produce containers for prestigious brands such as Hennessey, Glenfiddich, and Grey Goose. The funding for the acquisition includes a $A450 million institutional placement, a $A895 million 1-for-2.55 accelerated non-renounceable pro rata entitlement offer (“Equity Raising”), and A$875 million in debt financing.

The equity will be issued at a price of $2.70 per share, representing a substantial 21% discount from the previous sale price of $3.52 on Monday. To facilitate the acquisition announcement, Orora shares were placed on a trading halt on August 28, subsequently entering a voluntary suspension.

Orora stated that Saverglass’s enterprise value of 1.29 billion euros ($1.39 billion) corresponds to a multiple of 7.7 times adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) for the 12 months ending June 30. The company anticipates the acquisition to contribute positively to its earnings per share in the first full financial year of ownership (expected to be 2024-25).

From a pro forma perspective, Orora asserts that the acquisition results in a remarkable “c. 69% uplift in Orora’s Underlying FY23 EBITDA to around A$749 million (excluding any pro forma synergies),” leading to a 320 basis points increase in Underlying EBITDA margin.

Saverglass will become a pivotal component of Orora’s global glass business unit, functioning as a third growth platform. Integration of Orora’s existing facility in Gawler, Adelaide, with Saverglass’s portfolio will establish a global network of high-performance production facilities. This integration process is expected to transpire over the next year.

Saverglass’ CEO, Jean-Marc Arrambourg, will oversee the new division, supported by Orora’s experienced glass leadership team alongside Saverglass’ capable management team, who will remain in place. Orora emphasizes the low integration risk due to the strength of Saverglass’ local management team, with an average tenure of 15 years.

In summary, Orora’s acquisition of Saverglass represents a significant step toward its expansion in the global glass market, enhancing its product offerings and growth prospects.

Image from: https://www.saverglass.com/