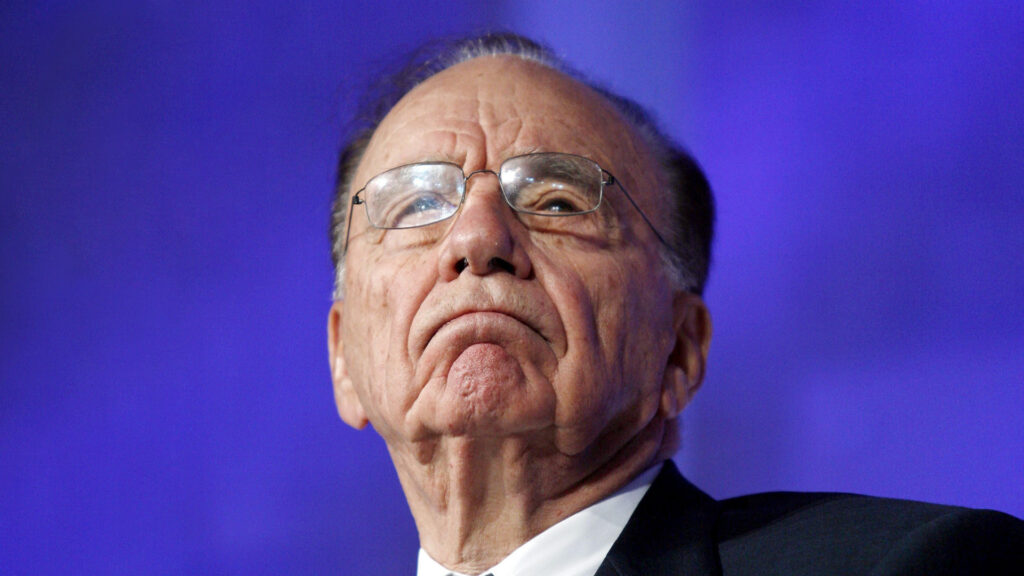

Consider two globally renowned nonagenarian businesspeople with very well-known names and enormous reputations—so much so that their surnames alone, Warren Buffett and Rupert Murdoch, are headlines in their own right.

After celebrating his 92nd birthday in April, Rupert Murdoch has now assumed the role of ‘chairman emeritus’ in a remote corner suite, retiring from his ‘modest’ media enterprises. He remains full of anger, often lashing out at perceived ‘elites,’ forgetting that he himself has been a member of the most elitist of all groups—the global billionaire class.

Then there’s Warren Buffett, who turned 93 in August. He is also a global billionaire, but he doesn’t concern himself with elites. Instead, he continues to oversee the world’s most closely followed company among investors—Berkshire Hathaway. As of Thursday’s close, its market value stands at just over $US792 billion (more than $A1.2 trillion).

Compare that to the ‘small fry’ in the Murdoch empire—Fox Corp, valued at $US15.14 billion, and News Corp, the foundation company, valued at $US11.52 billion—for a total value of $US26.66 billion ($A41 billion).

According to US data, Berkshire’s shares have surged by 46,400% over its approximately 70 years under Buffett’s control. Some of his original partners in his first investment groups have become billionaires many times over after sticking with him through thick and thin.

In contrast, News Corp shares have risen by just 30% since its 2013 split, which separated the empire. Fox Corp, the new incarnation of the 21st Century Fox company created during that split, has seen its shares fall by 23% since its establishment in 2019.

Very few individuals have amassed wealth by following the Murdochs in the same way that people have by following Buffett and Berkshire. The value of Murdoch’s companies is not insignificant, and because it’s a media conglomerate, Murdoch’s views have often appeared more important than they truly are, given his history of wielding power through his media positions and outlets.

Murdoch’s upbringing as the son of the well-known Australian war correspondent and media manager, Keith Murdoch, seemed to drive him to rebuild the media empire his father had constructed.

Buffett, on the other hand, began as the son of a former Republican US Congressman and therefore had a better understanding of the nuances of politics (and occasional disdain for it). Buffett has remained a lifelong Democrat, a starkly different political stance in the US compared to Murdoch.

The Murdoch family has received hundreds of millions of dollars over the years from News Ltd, News Corp, and now Fox and News. In contrast, Buffett is paid a nominal salary—$US100,000 a year for 40 years, with additional payments for security, transportation, etc.

Buffett has lived in the same house in Omaha, Nebraska, for decades, while Murdoch has owned homes, houses, and flats in Australia, the UK, and the US, particularly in New York and LA.

As businesspeople, Buffett and Murdoch have vastly different track records. Apart from his company’s substantial $US350 billion investment portfolio, Buffett and Berkshire are value investors with an extraordinarily long time horizon. Buffett was a long-time believer in the media, particularly newspapers, having once been a newspaper delivery boy. He owned the Buffalo News in upstate New York for decades and was the biggest investor and supporter of Katherine Graham at the Washington Post. He supported her until her death in 2001 and was a shareholder when Amazon founder Jeff Bezos purchased the company in 2014. He also invested in the ABC Capital Cities TV network, owned a string of local papers across the US Midwest and South but sold the last of his newspaper investments in 2020.

Buffett and Berkshire dominate the US business and investment landscape unlike any other—holding the largest stakes in Apple, Bank of America, Chevron, Occidental, Coca Cola, Amex, and the world’s largest group of insurance and reinsurance companies.

Murdoch, however, saw media as a means to power but struggled to translate that into long-term business success. His papers lost readership, broadcast media lost viewers and subscribers, and these days, the major sources of revenue and earnings come from real estate listings companies in Australia and the US, business data in the US and globally.

While News Corp dominates the print and subscription TV businesses in Australia and Fox News Channel is a major right-wing media outlet in America, they don’t generate the kind of returns that Buffett has consistently delivered from ordinary, and sometimes unfashionable, businesses.

A significant portion of the Murdoch family fortune is tied up in Disney shares held by the Murdoch Family Trust, which has lost nearly 30% of its value in the past five years since the deal with 21st Century Fox.

At various times, Murdoch has held stakes in the Ten Network in Australia and Ansett, the now-defunct Australian airline (along with partner TNT, which has also disappeared).

The most telling difference between the perpetually irate Murdoch and the remarkably calm Buffett, however, lies in their approach to charity. Since 2006, Buffett has donated shares from his own holdings in his company to various charities, with a total value of $US56 billion—a sum greater than his net worth in 2006. As of this week, he is worth $US124 billion.

As for Rupert Murdoch, his charitable activities remain unknown. He is preoccupied with succession, which he has now secured, and the family fortune is ensconced in the family trust located in a lawyer’s office in Reno, Nevada—an American state known for its high level of legal financial secrecy, somewhat reminiscent of Switzerland in decades past. This trust controls both companies through a dominant position in the voting shares issued by both (Berkshire also has voting and non-voting shares). The value of the fully diluted 14% stake, including both voting and non-voting shares, is estimated to be around $US4 billion at best.

In terms of the investment markets, the comparison is clear: Warren Buffett outperforms Rupert Murdoch by every measure.