Dr Shane Oliver, Head of Investment Strategy & Chief Economist at AMP, discusses developments in investment markets over the past week.

Investment markets and key developments

Global share markets fell again as uncertainty over Trump’s tariffs and the gathering global trade war added to fears about a hit to growth and profits. After four weeks of declines the US share market has had a 10.1% fall from its high and global shares have fallen 8.5%. Eurozone shares have been far more resilient having had just a 3.4% fall from their high reflecting better valuations and optimism regarding significant fiscal stimulus in Germany. Japanese and Chinese shares bucked the trend though and managed to rise over the week. Reflecting the negative US lead Australian shares fell around another 2% with falls led IT, health, retail and financial shares. This takes its fall from the February high to its recent closing low to 9.4%. US bond yields fell with safe haven demand and recession worries, but yields rose a bit more in Europe on fiscal stimulus plans and in Australia and Japan. Oil prices fell as OPEC increased supply, but metals rose (partly reflecting US buying ahead of possible tariffs) and iron ore prices also rose. Gold prices made it to a new record high due to safe haven demand and US buying ahead of possible tariffs. The $US rose slightly & the $A fell slightly. But Bitcoin fell with shares.

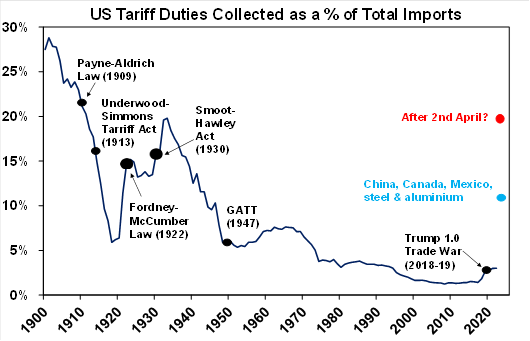

More mayhem from Tariff Man. The past week saw Trump’s 25% tariffs on all steel and aluminium imports to the US start as scheduled with no exemptions. This in turn saw the global trade war ramp up with the EU and Canada announcing retaliatory tariffs, Trump threatening a 200% tariff on EU wine and briefly pushing up the tariff on Canada to 50% after Ontario briefly imposed a 25% tax on electricity exports to the US. There is a long way to go though, with 2nd April shaping up as the big day: with exemptions scheduled to be removed from some of the tariffs on Canada and Mexico along with the start of “reciprocal tariffs” presumably on all countries and tariffs on various industries including semi-conductors, autos, pharmaceuticals, copper and agriculture. Trying to make sense of this and work out the end point remains difficult with Trump at times focussed on redressing the rest of the world “ripping us off” in some way and at other times seeking to bring production back to the US. But there is now a real risk that after 2nd April average US tariffs will have risen to levels around or maybe even higher than they were after the Smoot-Hawley tariffs of 1930. These famously contributed to the severity of the Great Depression as other countries retaliated and global trade collapsed.

A big risk for the US is that other countries get to a point where they have had enough and refuse to negotiate with Trump. While he thinks the rest of the world is “ripping us off” other countries may see it the other way round with America’s dominant culture and big companies “ripping them off” and so conclude that they don’t really want to negotiate if it involves having to give up things that are reasonable (like Australia’s GST and biosecurity laws). Just as people have turned off Tesla (with its shares halving in value) the same could happen more broadly for US companies.

Source: US ITC; EvercoreISI; AMP

Rising risk of recession. Trump’s erratic tariff announcements combined with DOGE’s manic cuts to the Federal workforce and service delivery at a time when the US labour market has cooled down and households have run down their pandemic savings buffers are increasing the risk of a US recession. The uncertainty is already becoming apparent in confidence which in time risks showing up in spending. Trump’s refusal to rule out a recession and others in his administration saying a recession might be “worth it” and referring to a “detox period” are adding to investor concerns.

US shares slide into a correction with a 10.1% fall from their high, but there is a high risk of more weakness ahead. We remain of the view that rising economic pain via pressure on Republican politicians and a plunge in shares will see Trump back off resulting in tariffs settling at below Smoot Hawley levels and that this along with more fiscal stimulus from tax cuts later this year and a resumption of Fed rate cuts will see shares bottom and start to recover. A first test of the political pressure on Trump will come with elections on 1st April for two Congressional House seats vacated by Republicans but it’s too early to expect a back down just yet as the tariffs have a way to go. So far US, global and Australian shares have had falls around 8-10% from their highs but in 2018 it took a near 20% fall in the US share market before Trump started to back off. So while shares are oversold and could bounce a bit more in the short term, we continue to see a high likelihood of a 15% plus correction in global and Australian shares from recent highs before the tariff war settles down and more positive forces around Trump’s tax cuts and deregulation and more Fed rate cuts get the upper hand.

Adding to the uncertainty in the very near term is the risk of a partial US government shutdown but fortunately this risk may be receding. Congress needs 8 Democrats to pass a continuing resolution to avoid a shutdown by Friday night (14 March). Democrats don’t want to be seen shutting down the Government but also want to push back against DOGE cuts. At the time of writing, it looks like the former argument is dominating amongst Democrats so the risk of a shutdown is easing. Either way it’s worth noting that US government shutdowns have been common in the past but they have not had much impact on GDP or share markets, but this time could be different given the huge uncertainty swirling around Washington.

Well I guess at least Trump is sensitive to the damage being caused to at least one business – so much so that he turned the White House front lawn into a Tesla car sales yard and urged us to help out the world’s richest man after a global backlash against Musk saw a plunge in Tesla sales and Tesla’s share price – which is being dubbed the “Tesla Chainsaw Massacre”!

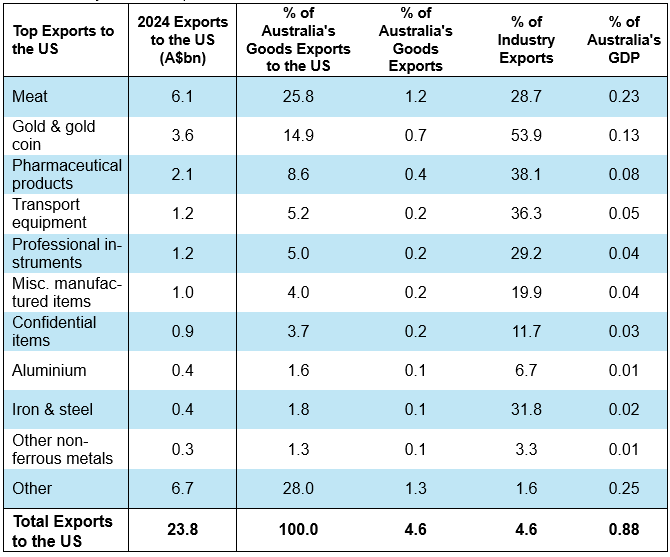

No exemption for Australia on the steel and aluminium tariffs – at least not yet – and it’s hard to see Australia avoiding many of the other tariffs Trump is proposing from 2nd April. President Trump’s trade adviser Peter Navarro’s claim that Australia was “killing the aluminium market” makes no sense as last year only 2% of US aluminium imports came from Australia. And Australia’s trade deficit with the US meant that we had a strong case for an exemption but its clearly about more than that given the Trump administration’s desire to return more production to the US and irrational perceptions that the rest of the world – which presumably includes Australia – is “ripping us off.” Next in the firing line are our pharmaceutical exports to the US (worth $2.1bn and more than double our US steel and aluminium exports) and meat (worth $6.1bn) and more broad based “reciprocal tariffs” on all our exports which he might “justify” by taking a dislike to the GST, bio security laws, the news media bargaining code and our spending of only 2% of GDP on defence when the US spends 3.4%. The key is to put this in perspective though – compared to other countries we are a small exporter to the US with a total value of $24bn last year or 0.9% of our GDP. The main threat to Australia comes from Trump’s trade war leading to a hit to global trade and growth leading to less demand for our exports. And this is largely why our share market has had a similar sized fall to the US share market.

Source: ABS, AMP

Should Australia retaliate by putting tariffs on US imports? No. PM Albanese is spot on in his assessment that tariffs and trade tensions are “economic self-harm”, that is paid for by consumers and that “we won’t impose reciprocal tariffs on the US” as that would only push up the cost of living for Australians.

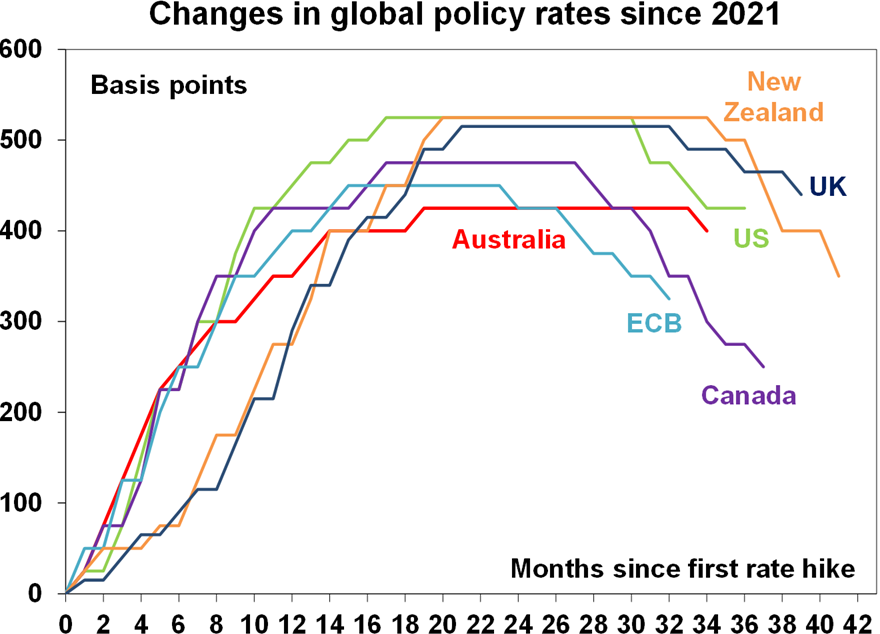

What do Trump’s tariffs and the escalating trade war with the US mean for the RBA? Basically, they add to the case for more rate cuts. This is because the escalating US tariffs pose more of a downside risk to Australian growth and less of an upside threat to inflation – as we won’t be putting tariffs on imports from the US and any boost to inflation from a weaker $A will be offset by weaker economic growth. So, we continue to see the US tariffs as adding to the case for further RBA rate cuts and our view remains for the next cut in May followed by further rate cuts in August and February. A continuing escalation in the global trade war would mean that the RBA will cut more aggressively.

The upcoming Federal Budget on 25 March is likely to see more stimulus. The good news is that the revenue windfall from stronger than expected employment and key commodity prices along with bracket creep will mean the starting point for the budget will be $10-15bn better this financial year and next. But the Government has already racked up an extra $35bn since January in spending promises over the next four years (on Medicare, roads, the NBN, etc), there is likely more to come in the Budget with:

- another round of $300 per household electricity rebates or something similar costing $3.5bn in the next financial year (otherwise average electricity bills could rise 30% or so reflecting another rise in underlying electricity prices on 1 July and the current gap between underlying and subsidized prices);

- subsidies to support Australian industries affected by tariffs (like investing in green steel) and maybe more spending on Future Made in Australia subsidies (all of which is economically dubious and just another form of protectionism);

- more funding for a buy Australian campaign;

- maybe another round of income tax cuts giving back some bracket creep; and

- extra disaster spending for ex-Cyclone Alfred.

Netting this out will likely see this financial year’s budget deficit forecast revised to around $13bn (from $26.9bn in MYEFO) and next year’s to $42bn (rom $46.9bn)with deficits still projected out to mid next decade. The Government’s growth forecasts are likely to be revised down slightly for this year to 1.5% rising to 2.5% next year, with unemployment being revised down to around 4.2% and inflation forecast to remain around 2.5% helped by another round of electricity rebates.

Major global economic events and implications

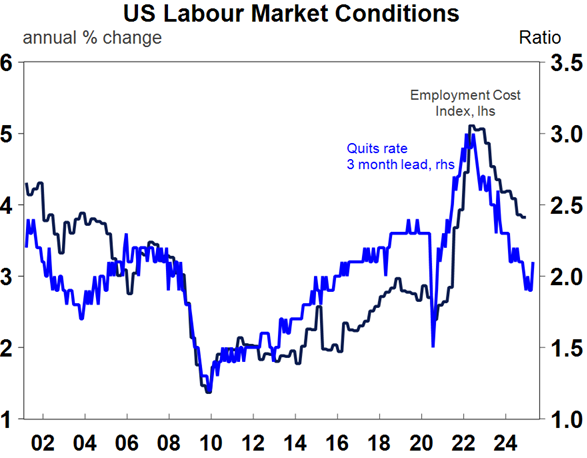

US economic data was a mixed bag. Job openings and quits rose in January, but this is ahead of DOGE cutbacks and Trump policy uncertainty impacting so it’s somewhat stale data. The downtrend in openings & quits still points to a downtrend in wages growth though.

Source: Macrobond, AMP

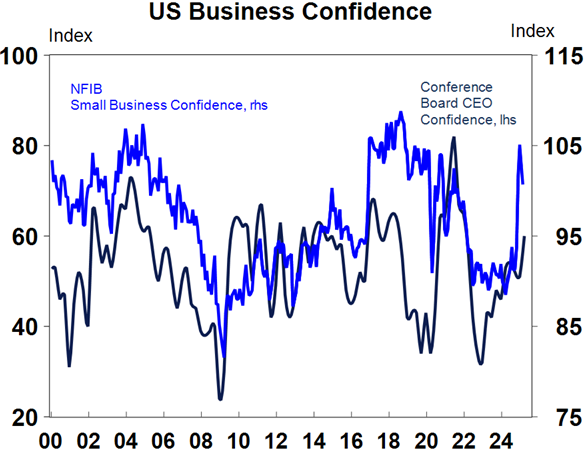

Meanwhile, small business optimism fell in February as selling prices and uncertainty rose on the back of tariff concerns.

Source: Macrobond, AMP

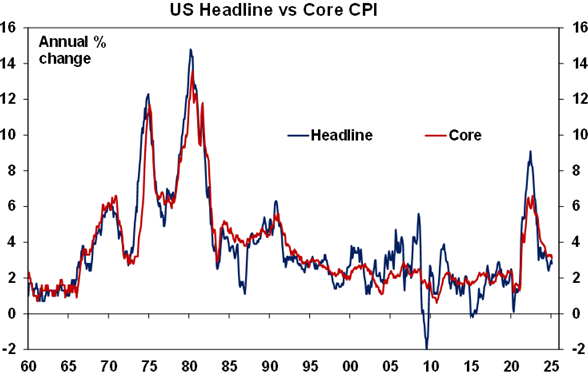

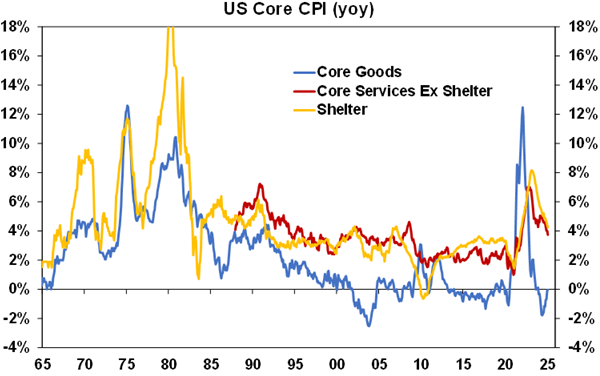

US CPI inflation surprised on the low side in February seeing a fall to 2.8%yoy with core (ex food and energy) CPI inflation falling to 3.1%. Producer price inflation also came in a bit softer than expected and fell on an annual basis.

Source: Bloomberg, AMP

Annual growth in US services and rent inflation is also continuing to slow. The only problems are that the read through to core private final consumption expenditure inflation is not as benign pointing to a rise of around 0.3%mom or 2.75%yoy and we will likely see some upwards pressure on inflation in the months ahead from the tariffs. So, the Fed will likely remain cautious for the time being. But money market expectations for three more rate cuts as growth cools taking pressure of inflation still look about right, but absent a share crash a move to start cutting again is unlikely until mid-year.

Source: Bloomberg, AMP

The Bank of Canada cut its policy rate again by another 0.25% to 2.75% citing “pervasive uncertainty created by continuously changing US tariff threats”. It indicated that it would proceed carefully but expect two more cuts to come this year as the economy comes under pressure from Trump’s tariffs.

Source: Bloomberg, AMP

The German centrist parties modified their fiscal easing plans – around infrastructure and defence – to include concessions to the Greens in order to pass the Bundestag. Odds are that it will be passed, and along extra EU spending should provide a 1% of GDP or so boost to European growth over the year ahead.

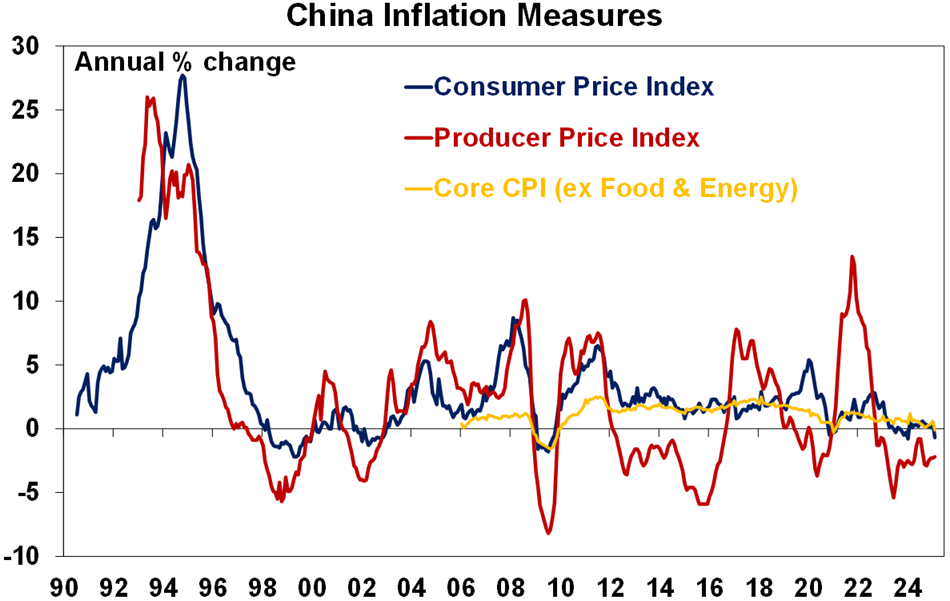

China slipped back into consumer price deflation in February with the CPI down 0.7%yoy. This was largely due to a sharp fall in food prices owing to the early timing of the Lunar New Year this year but core (ex food & energy) inflation also fell to -0.1%yoy from +0.6%yoy in January. Expect some bounce back in March but its still likely to remain very low. Particularly with produce prices remaining in deflation at -2.2%yoy. Its all consistent with the need for more policy stimulus.

Source: Bloomberg, AMP.

Australia economic events and implications

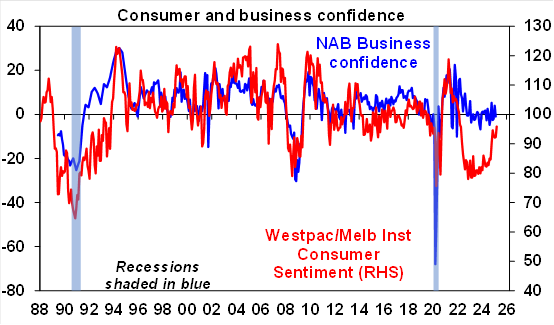

In Australia, consumer confidence resumed its recovery in March rising to a three year high with consumers continuing to see now as an improving “time to buy major household items”.

Source: Westpac/MI, NAB, AMP

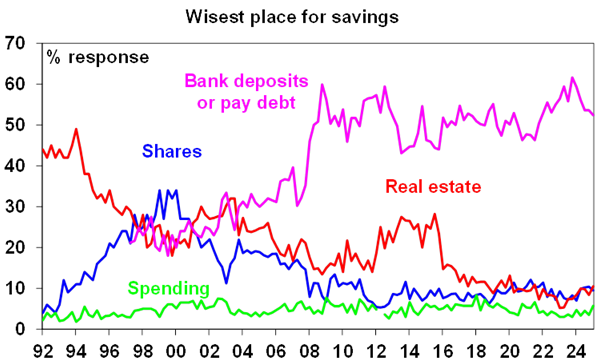

Slightly reduced consumer caution was also evident in less nominating paying down debt and bank deposits as the wisest place for savings and more nominating “spending” and real estate. There was also a further rise in the proportion of consumers seeing now as a better time to buy a dwelling, albeit it’s still weak.

Source: Westpac/MI, AMP

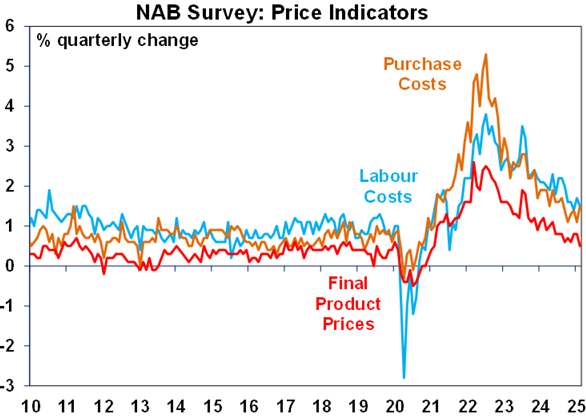

In contrast to improving consumer confidence, the February NAB business survey showed a fall in business confidence which is around average levels, but a slight rise in conditions which are continuing to trend down. The good news though was while purchase cost pressures rose, labour cost growth and selling price growth continues to slow suggesting that underlying inflation pressures are continuing to ease.

Source: NAB, AMP

What to watch over the next week?

In the US, the Fed (Wednesday) is expected to leave its key policy rate on hold at 4.25%-4.5% reflecting recent stickiness in inflation, solid growth and uncertainty about the impact of Trump’s policy changes. Powell is likely to reiterate that it’s in no hurry to cut rates but is also likely to maintain a mild easing bias. On the data front expect a bounce back in February retail sales but still soft home builder conditions (both Monday), a slight slowing in growth in industrial production and still weak housing starts (both Tuesday), a further fall in existing home sales (Thursday) and a slight weakening in manufacturing conditions in the New York and Philadelphia regions.

Canadian inflation (Tuesday) is expected to rise slightly to 2.2%yoy in February, but with underlying measures remaining around 2.7%yoy.

In Europe the Bank of England and Swedish central bank (Thursday) are both expected to leave their interest rates on hold at 4.5% and 2.25% respectively whereas the Swiss central bank (also Thursday) is expected to cut to 0.25% from 0.5%.

Japanese inflation data for February (Friday) is expected to fall to 3.7%yoy with core inflation falling slightly to 1.4%yoy from 1.5%.

Chinese data for January/February (Monday) is expected to show a slowing in growth in industrial production to 5.3%yoy, retail sales growth picking up slightly to 3.8%yoy and unchanged growth in investment at 3.2%yoy.

Australian jobs data for February (Thursday) is expected to show a slowing in jobs growth to 25,000 with unemployment unchanged at 4.1%.

Outlook for investment markets

After the double digit returns of 2023 and 2024, global and Australian shares are expected to see far more constrained returns this year. Stretched valuations, the increasing risk of a US recession, Trump’s trade war and ongoing geopolitical issues – including a high probability that the US will launch strikes against Iran’s nuclear capability if diplomacy doesn’t work – will likely make for a volatile ride with a 15% plus correction highly likely. But central banks, including the RBA, still cutting rates, prospects for stronger growth later in the year supporting profits, and Trump’s tax and deregulation policies ultimately supporting US shares, should still mean okay investment returns.

Bonds are likely to provide returns around running yield or a bit more, as inflation slows to target, and central banks cut rates.

Unlisted commercial property returns are likely to improve in 2025 as office prices have already had sharp falls in response to the lagged impact of high bond yields and working from home.

Australian home prices have likely started an upswing on the back of lower interest rates. But it’s likely to be modest given poor affordability. We see home prices rising around 3% in 2025.

Cash and bank deposits are expected to provide returns of around 4%, but they are likely to slow as the cash rate falls.

The $A is likely to be buffeted between changing perceptions as to how much the Fed will cut relative to the RBA, the negative impact of US tariffs and a potential global trade war and the potential positive of more decisive stimulus in China. This could leave it stuck between $US0.60 and $US0.70, but with the risk skewed to the downside as Trump ramps up tariffs.

Ends